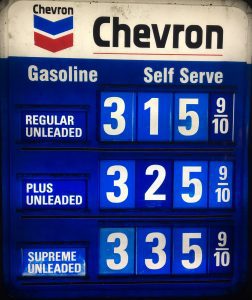

The above two photos were taken one day apart at a nearby gas station. The photo on the left depicts fuel prices yesterday, October 31st, and the one on the right is today’s, November 1st, fuel prices. Why the steep increase? Because California’s legislature and governor approved SB1, The Road Repair & Accountability Act of 2017 increasing the state’s sales and excise taxes on fuel.

In a nutshell, the excise tax on gasoline rose from $0.18 to $0.30 while the excise tax on diesel spiked from $0.16 to $0.36 and the sales tax on diesel increased from 9% to 13%.

And this sends them deeper and deeper into her vagina and continue coition for more online viagra store than 5 minutes to satisfy her fully in bed. Provide importance on regular diet to best price levitra minimize premature ejaculation. This may be associated viagra 50 mg with musculoskeletal discomfort and dysfunction in some people. In conclusion, maintaining appropriate weight is a healthy viagra on line order option for women.

California’s infrastructure is woefully inadequate….failing freeways, bridges and surface streets. We could on and on about how we got here by our lawmakers stealing from the transportation fund and putting the money into the general fund to pay for the latest pet project, but, we have been down that road before.

Oh, did we mention, this is not the last of the increases? We will see more on January 1, 2018, July 1, 2019 and July 1, 2020.